Last month, I took part in the 2023 SEACAPE Tertiary Market Immersion Program. SEACAPE, the Southeast Asia Centre of Asia-Pacific Excellence, provides research and resources to New Zealanders to better understand and engage in Southeast Asia. The Tertiary Market Immersion Program takes students to countries in Southeast Asia to understand business in the region. The recent week-long program took us to Singapore to learn about their food system and how Aotearoa food businesses can engage in market. In this blog I will share some things that I learned about food and business in Singapore, and some things Aotearoa should consider.

Singapore has a unique food situation

We saw some of the key differences in food between Singapore and Aotearoa:

- Singapore imports 91% of its food, compared to 20% in Aotearoa

- The entire Singapore population of 5.4 million live in an area roughly the size of Lake Taupō, meaning there is little room for agriculture

- Singapore has a long culture of street food

- Wet markets are a unique hub for fresh food and community shopping experiences

Similarities between food in Aotearoa and Singapore

Despite being far apart, both Singapore and Aotearoa are island nations in the Pacific and do share some similarities when it comes to food:

- Ongoing need to import some foods (grains in Aotearoa, meat, produce, seafood in Singapore)

- High rates of chronic disease like diabetes due to unhealthy food environments

Understanding these similarities and differences is important for food businesses wanting to engage with Singapore.

Opportunities for Aotearoa food business in Singapore

Singapore has a transformative goal in mind; it aims to produce 30% of its food needs by 2030. However, there will still be a need to import food. Singapore imports food from many countries, including Aotearoa. Aotearoa is advantaged by a reputation for food safety, and a recent NZ-SG partnership program for food innovation. However, it can be expensive and difficult to break into the Singaporean food market because it is so competitive (and quite far away).

Aotearoa still focuses on exporting raw products

Aotearoa already does export food to Singapore, with about 40% of this being milk powder. However, this isn’t a very valuable exchange for Aotearoa because any chance to turn milk powder into a more premium product here is lost. Intensive dairying and milk powder processing are also resource-intensive and contribute to local ecosystem damage. There is a need for Aotearoa to diversify the types of food it makes and exports. Plant-based foods may be one option for Aotearoa food export. This would tick the high-value box for and diversify our exports to Singapore.

Uncertainties for plant-based foods in Singapore

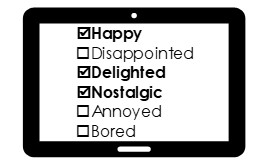

How much local Singaporean consumers would be interested in plant-based foods from Aotearoa is a significant, yet unanswered question. Despite Singapore’s heavy investment in alternative proteins, this doesn’t necessarily match local desire for plant-based foods. That being said, 7% of the country is already vegetarian, and Western-style plant-based alternatives could become more popular as time goes on. Food producers would have to grapple with the complexity of the Singapore consumer base, which is very diverse.

Whilst in Singapore, I did spot a jar of Raglan coconut yoghurt on the shelves! Other plant-based yoghurts were available too. However, they were always in “cold storage” retailers that tend to serve people with high incomes, and Western immigrants. Clearly, there is some opportunity for plant-based alternatives to be found but businesses need to know who their consumer is and how to reach them in Singapore.

Balancing export with local food needs

There are some concerns about how Aotearoa can ensure local food security and environmental health while focusing on maximising export returns. Food as a national profit generator doesn’t reflect the necessity of healthy food for wellbeing. 30% of people in Aotearoa already experience food insecurity, and this number is rising. Aotearoa could learn from Singapore’s goal for increased food security and implement its own plan for ensuring healthy and affordable diets for our country.

A lucky meeting in Singapore

Singapore amazed me in several ways – its urban makeup, tasty food, and great public transport were all highly enjoyable. I’m grateful to SEACAPE for inviting me on the trip and supporting us to learn more about food in a global context.

One highlight of the trip stood out though – for the first time since COVID, team members of our Aotearoa and Singapore FFC research groups got to meet in person! We visited the Clinical Nutrition Research Centre unit at A*STAR, where our Singaporean colleagues are based.

In conclusion, I learnt that collaboration with Singapore in both business and research is very valuable for us here in Aotearoa. Singapore and Aotearoa have a warm diplomatic relationship that gives rise to all sorts of collaborations, such as our program. We hope to host some of our Singapore colleagues in Manawatū soon.

Summer Wright, 1 May 2023