Hybrid meats combine meat and plants

Hybrid meats are processed meat products in which a part of the meat is replaced with plant-based ingredients. The plant-based ingredients can be vegetables or plant proteins such as soy or pea protein. Hybrid meats are typically available as mince, sausages, or burger patties.

Why have hybrid meats?

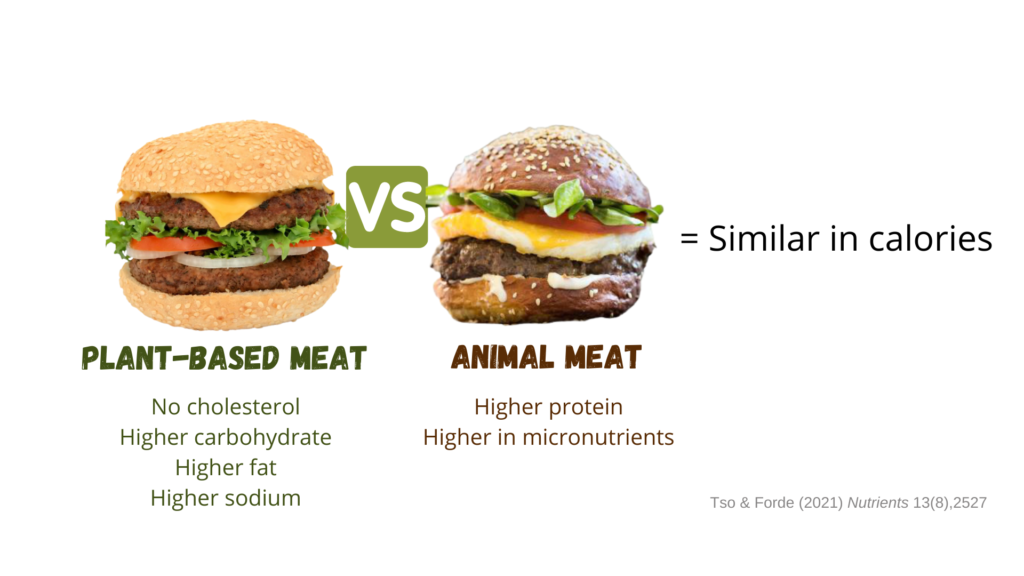

Hybrid meat products are promoted to help consumers with their transition to a more plant-based diet. As hybrid meats still contain meat, they can appeal to consumers wanting the familiar taste and texture of meat. Furthermore, hybrid meats could be healthier than regular meat products. The addition of vegetables can decrease calories and saturated fat and increase fiber, vitamin, and mineral content.

What do consumers think?

A study which did not involve tasting samples, found only 27% of respondents would choose a hybrid product over a meat product as they thought it would not taste as good. This indicates consumer beliefs about hybrid meats could be a barrier to their success.

Another study where participants tasted samples showed more positive results for hybrid meats. Among meat eating consumers, hybrid meat burgers were found to be similarly liked to a full meat burger and preferred over a plant-based burger due to possessing a meaty flavour that the plant-based burger lacked.

Availability of hybrid meats

Only a limited selection of hybrid meat products are available to purchase in New Zealand. Green Meadows offer a range of Beef and Beetroot and Beef and Kumara products and Beehive offer Flexitarian Beef and Beetroot Sausages.

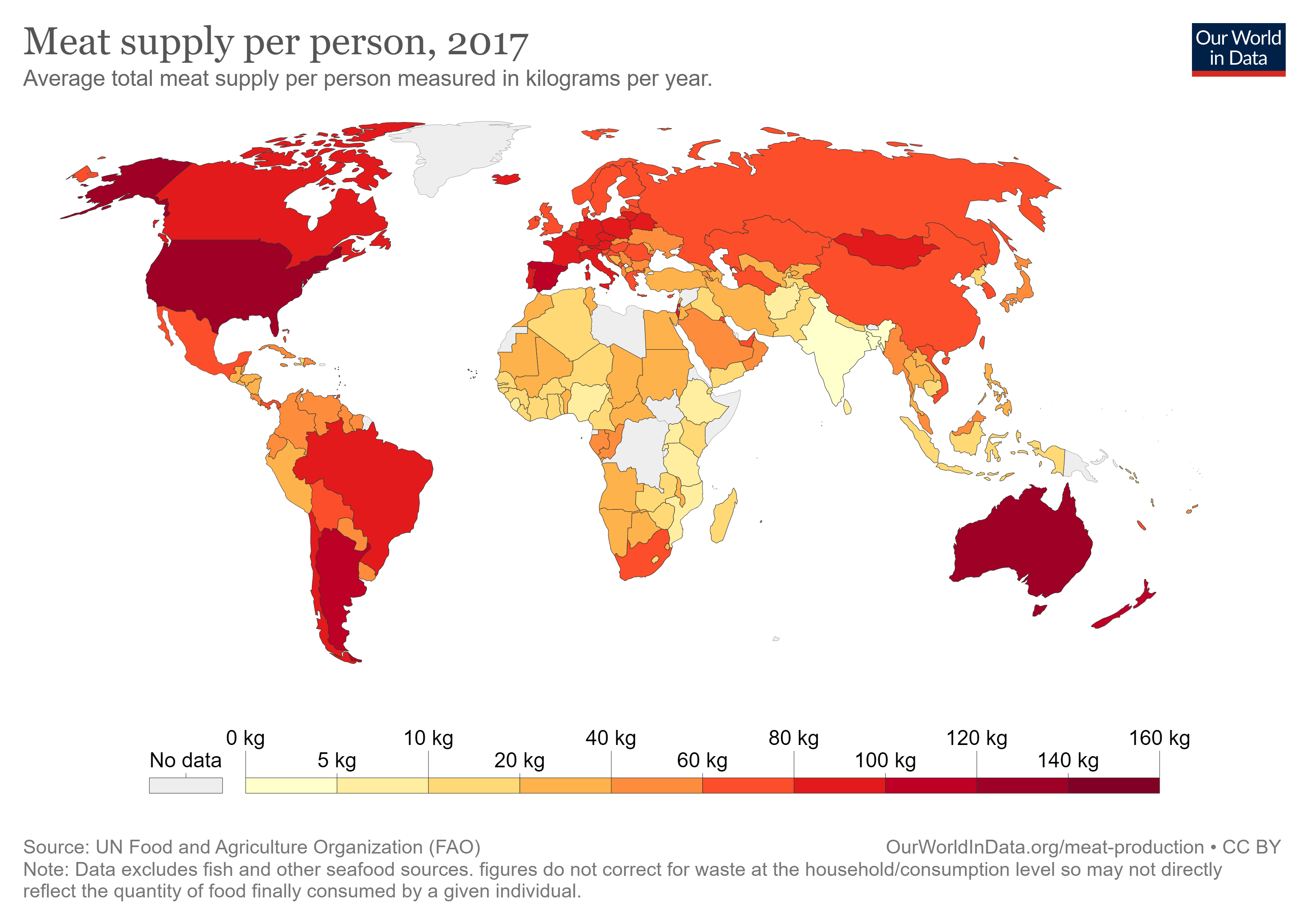

There is greater availability of hybrid meat products overseas, especially in UK, Europe, and the USA. However, these products are struggling to find their place in the market, and many are failing to sell.

Many hybrid products are discontinued

In the UK, 38 hybrid meat products were launched between 2016 and 2020. However, most of these products were discontinued with only 12 still available. In the US, Tyson Foods, one of the world’s largest processors of meat, launched The Blend, a burger combining angus beef with pea protein. However, The Blend was soon discontinued as there was greater consumer demand for fully plant-based products.

Target groups for hybrid meat are unclear

Experts believe the biggest issue with hybrid meats is brand positioning. Hybrid meats overlap the plant-based and meat markets so are often marketed towards flexitarians. However, replacing part of the meat in a meal does not fit into the conventional idea of a flexitarian diet which typically includes meat free days or meals. On the other hand, targeting meat eaters is also a challenge as meat eaters likely have little interest to reduce their meat intake.

Other issues with hybrid meats include:

More expensive than conventional meat

Easy to replicate at home

Not all hope is lost for hybrid products

Supermarket retailer Tesco’s has been successful with their Meat and Vege range which includes mince, sausages, patties, and meatballs containing 30% vegetables. UK based Heck Sausages has also been successful with their 60:40 range of sausages containing 60% meat and 40% vegetables.

Promoting convenience as a marketing strategy

The success of Tesco’s Meat and Vege range could be due to avoiding branding as a flexitarian product and not highlighting the lower meat content. Instead, the convenience of having vegetables already included and containing “1 of your 5 a day” per portion is promoted.

Hybrid meats have potential to be a solution to meat reduction. However, further research is required to better understand consumer perception and how to best market them to attract consumers.

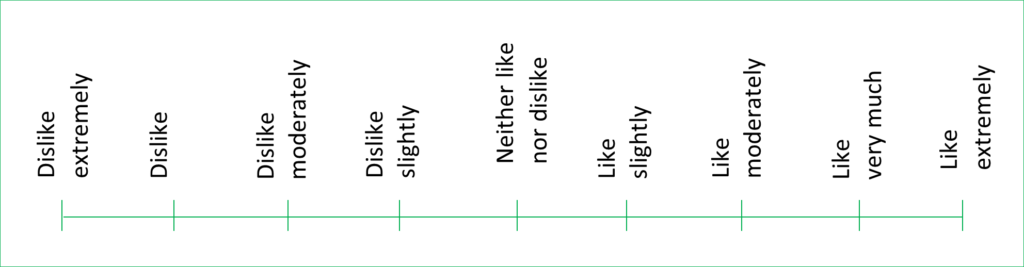

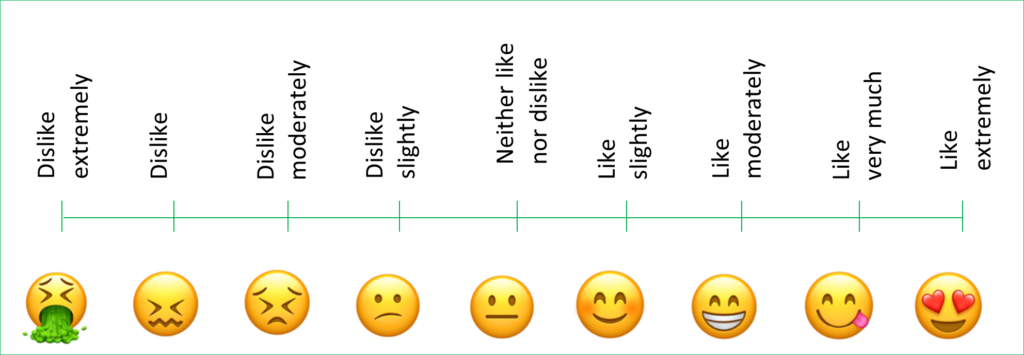

Rebekah’s research will help better understand New Zealand consumer opinions of hybrid meat products by investigating consumer sensory experiences and emotional response to a hybrid meat burger along with a full meat burger and a range of plant-based burgers.

Rebekah Orr, 5 Apr 2022